For property investors, finding the right deal often comes down to timing and opportunity. One area that’s frequently overlooked but holds significant potential is fallthrough properties. These are properties where a previous sale has fallen through, leaving the seller back at square one and often more motivated to find a new buyer quickly.

But why should fallthroughs matter to investors? Let’s explore the advantages, backed by real world data and strategies for turning these opportunities into successful investments.

What Are Fallthrough Properties?

When a property sale collapses before contracts are exchanged, it’s classified as a fallthrough. This can happen for various reasons, perhaps the buyer couldn’t secure financing, a survey uncovered unexpected issues, or the chain broke down.

Whatever the reason, fallthroughs create opportunities. Sellers in this situation are often under pressure to relist their property quickly, and that’s where savvy investors can step in.

The Hidden Advantages of Fallthroughs

1. Motivated Sellers Mean Better Deals

Sellers whose sales have fallen through are often keen to move on as quickly as possible. This urgency can lead to greater flexibility in negotiations, whether it’s accepting a lower offer, agreeing to faster completion timelines, or including additional incentives.

If you’re prepared and ready to act, a fallthrough property could give you the upper hand in securing a better deal.

2. Less Competition

Fallthrough properties don’t always receive the same attention as new listings. Many buyers overlook relisted properties, assuming there’s something wrong with them. However, with the right tools and a keen eye, you can identify properties with potential while others dismiss them.

3. Opportunity to Address Issues

Sometimes, a previous sale falls through due to problems with the property itself. While this may seem like a red flag, it’s often an opportunity. For example, if a buyer walked away due to repair costs or survey results, you can factor these into your negotiations. Armed with the right information, you might secure the property at a lower price and still achieve a solid return on investment.

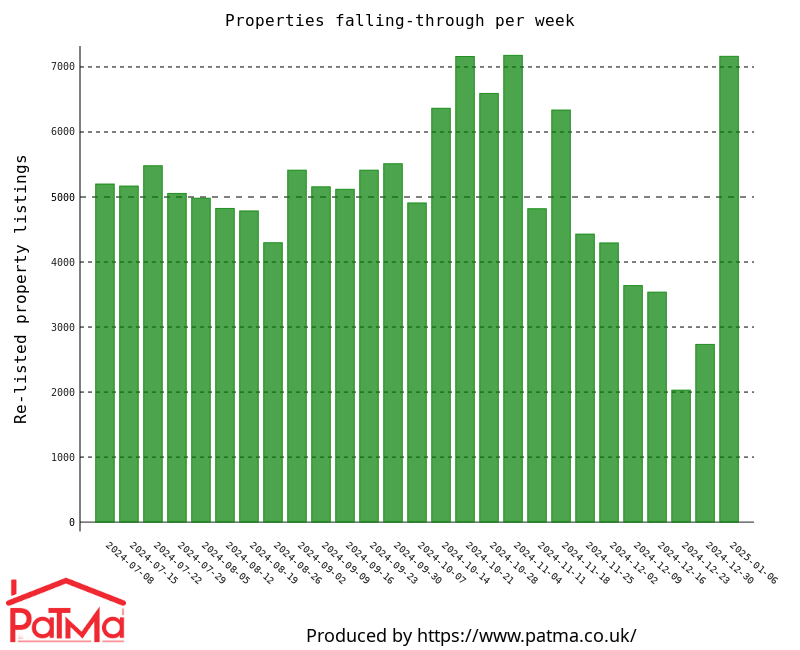

What the Data Says About Fallthrough Properties in England

In recent weeks, there has been a spike in fallthroughs in England. While this is likely a seasonal trend with people removing their listings from the market over Christmas and re-listing them in the new year, there are still nearly 5000 fallthroughs a week representing a significant portion of the market. As an investor, it’s a trend you can’t afford to ignore.

What’s particularly interesting is that these properties often come back onto the market at adjusted prices or with additional incentives, creating a unique window of opportunity. By monitoring fallthrough trends, you can stay ahead of the curve and identify times when sellers are more likely to be motivated. Signing up for a free PaTMa account gives you access to fallthrough trends every week along with other trends like listing prices, time on market etc.

How to Find Fallthrough Properties

While the concept of targeting fallthroughs is simple, identifying them can be tricky without the right approach. This is where technology and tools like PaTMa’s Deal Finder can make a real difference.

The Enhanced Property Search feature in PaTMa allows you to filter for fallthrough properties based on criteria such as price reductions, re-listings, and time on the market. These insights are invaluable for spotting motivated sellers and determining whether a property fits your investment goals.

But even without advanced tools, you can start by:

- Watching for price reductions on popular property platforms.

- Searching for properties that have been relisted within a short timeframe.

- Using historical data, such as past listings or price trends, to evaluate opportunities.

Final Thoughts on Fallthroughs

Fallthrough properties represent a hidden opportunity in the property market. While they might not be the first thing that comes to mind when you’re searching for your next investment, they often come with motivated sellers, less competition, and the chance to negotiate better terms.

Whether you’re a seasoned property investor or just getting started, keeping an eye on fallthrough trends and using tools like Deal Finder to simplify your search can give you a significant edge. With thousands of properties falling through each week in England, now might be the perfect time to include this strategy in your investment approach.