If you are deal sourcing and packaging (or investing for yourself) you need to know about comparables and how to use them. Comparables can help you spot opportunities and maximise returns for your clients.

What are property comparables?

In property being able to understand market value is critical.

Market value is what a willing and able buyer will pay for a property when it is offered on the open market.

Market value isn’t the same as the asking price, which may be more or even less than the market value. Market value is, or should be, the actual selling price.

Market value is mainly thought of as applying to property prices but it can also apply to rents. The market rent is what a tenant is willing and able to pay when the property is offered on the open, private rental market.

Comparables are the basis of market value. Comparables are what a similar property in the same local area has actually sold for recently.

Comparables are what all estate agents and valuers use as part of the process of determining market value and asking prices. They can be used just as effectively by deal sourcers and packagers, and investors.

Why are comparables useful?

Using and finding comparables – what similar property in the same area to a property you are considering buying actually sold for – is a very good way to help understand market value.

Better still, when you understand market value you can understand when a property is available at a fair price, a bargain price or is overvalued. It can help you spot when there is (or isn’t) an opportunity to make money by buying and selling.

Example – price comparables

Assume you are sourcing deals for an investor. You are considering suggesting that they consider a three bedroom detached house which has an asking price of £400,000. You check recent sales prices for similar properties in the area and find that they have ranged between £400,000 and £480,000. The comparables here would tend to suggest that the £400,000 asking price is not only in line with market value but potentially represents good value.

If on the other hand comparable sales prices in the area are £350,000 to £380,000 that might suggest that the £400,000 asking price is potentially too high.

Now, let’s assume that you check comparables and find that larger, 4-5 bedroom detached houses in the same area have recently sold for £550,000 to £600,000. That might suggest that there is an opportunity here for your client to buy the property, extend it or flip for a profit.

Example – rent comparables

Comparables can also be used for rents, if you are sourcing buy to let or perhaps BRRR deals.

Assume you are considering a two bedroom terraced house, as part of a sourcing deal for a client. It has an asking price of £250,000. You check asking rents for similar properties in the area (actual rental prices are not generally available) which suggests a monthly rental of £1,200 is possible. The likely yield is therefore £14,400 div. by £250,000 x 100 = a reasonable 5.76% gross yield.

If the asking rents in the area were around £700, or around £1,500, then the yield would clearly be different. In this case comparables can help you identify a good (or poor) buy to let package.

Important. Comparables are a useful tool but are not foolproof. In the real world, properties are rarely exactly the same and even adjoining streets may be very different. Recently property values have been on a steep upward curve and opinions differ on how they will move in future. So comparables should only be used as a guide.

How to find comparables

To make use of property comparables you first need to be able to find this information.

There are two main ways to find price (and also rent) comparables. You can trawl through estate agents’ websites and portals to find asking prices and asking rents. Bear in mind that asking prices are not the same as sales prices, so you’ll need to estimate a reasonable adjustment. You can also use one of the several sites that report house sales prices, such as Nethouseprices.com, and do a search based on postcodes or street names.

An easier and quicker alternative is to use PaTMa’s tools. PaTMa offers not just one but two tools to provide the essential comparables information you need:

-

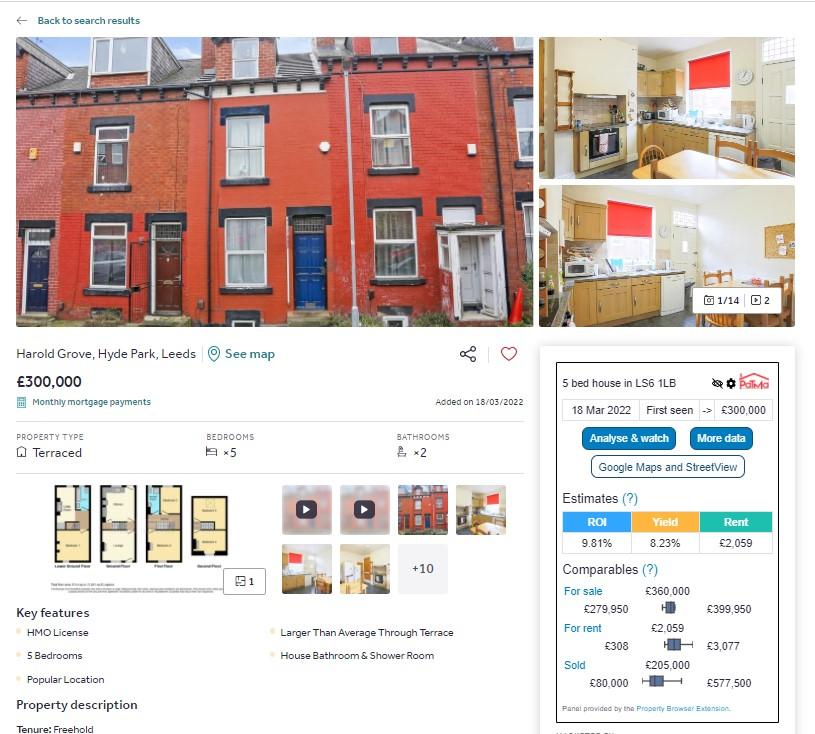

PaTMa’s free browser extension, which you can download here. Then, when you search using a portal price and rent comparables will be automatically shown for each listing you visit. Just click through for full details of nearby properties up for sale, for rent and actually sold. (Yield and ROI are shown too.)

-

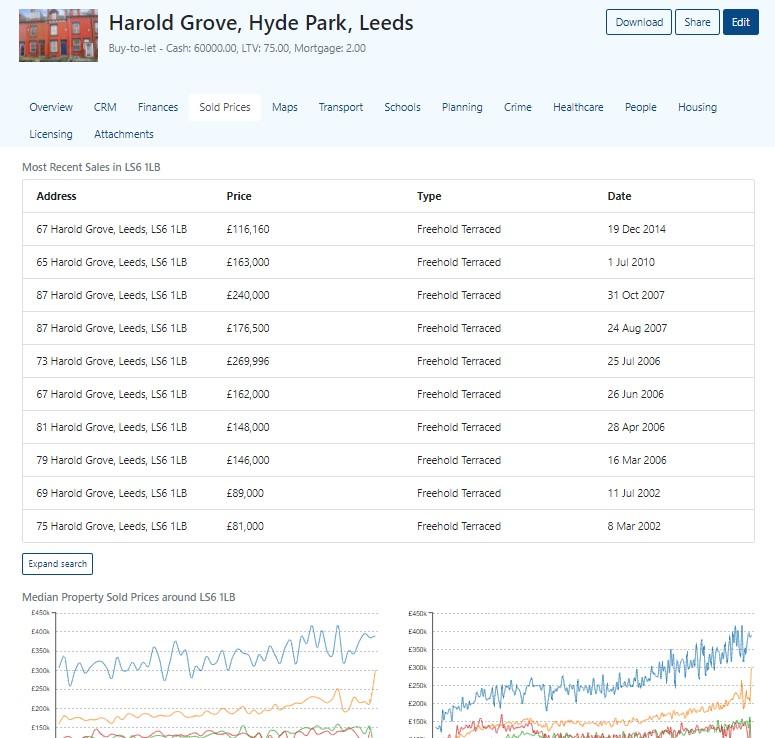

PaTMa Property Prospector, which you can subscribe to here. There are free starter and pro subscription options. Simply add a property as a prospect and Property Prospector will provide comparables information automatically in seconds. You can see details of recent sales in the area, median sales prices and total properties sold.

This is in addition to all the other essential information and analysis that Property Prospector can provide on properties you are interested in. Such as: Prices changes, sales history, time on market, ROI, yield, calculations for buying and project costs, rental profit, overall profit, mortgage and financial calculations and a wealth of local area information. Prospector is customisable to suit your client’s investment scenario.

Using property comparables can make deal sourcing and packaging (or investing yourself) so much more accurate and effective. PaTMa Property Prospector can provide information on property comparables instantly, saving hours or even days of your time.