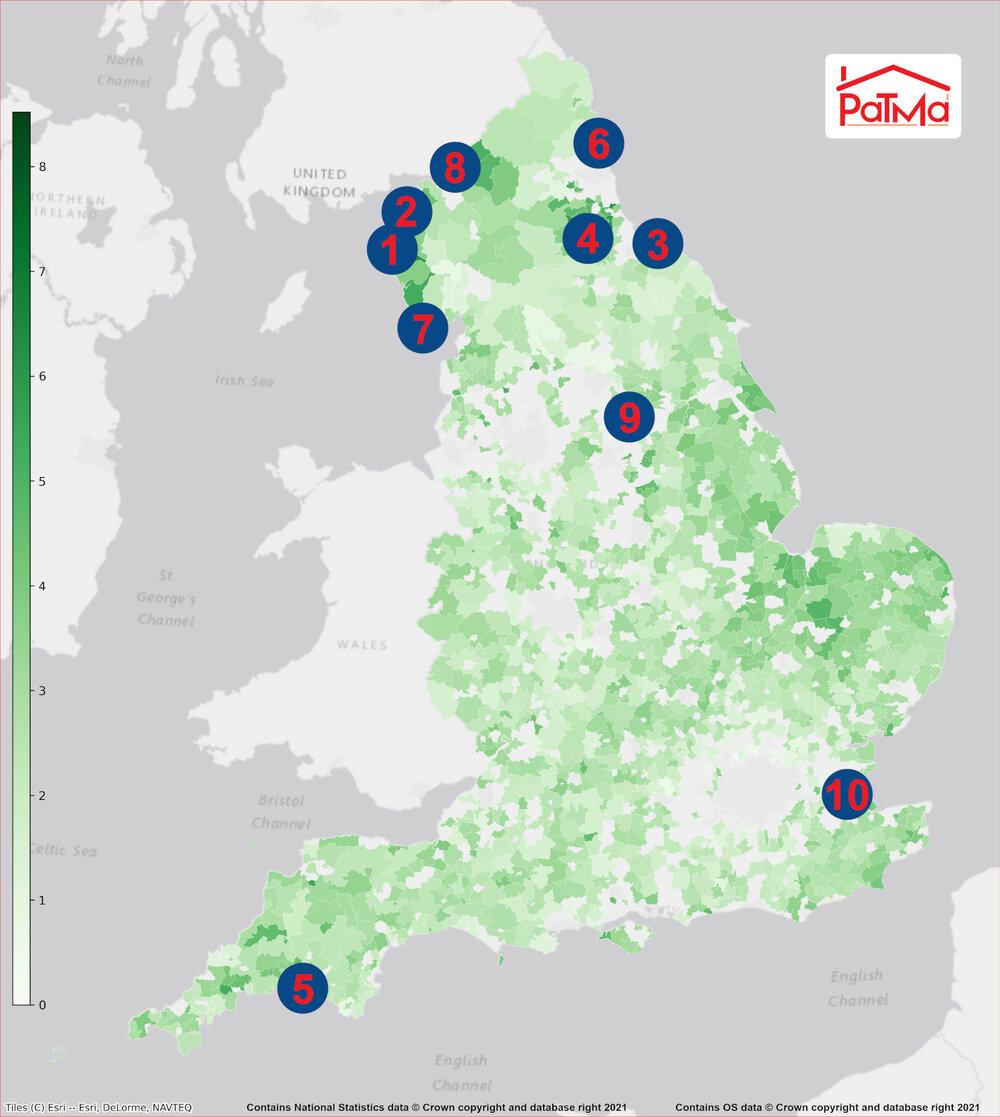

Where landlords can find the highest yielding country buy to lets

Coronavirus has caused tenants as well as buyers to reassess their priorities. Out are cramped flats in crowded cities. In are rural locations offering work from home potential, more outdoor space and less crowded public places.

To help buy to let investors capitalise on these new priorities PaTMa Property Prospector has crunched the numbers to find out exactly where landlords can find the best rural letting yields in the country.

1. Parton & Distington, Cumbria

Between Whitehaven and Workington and within reach of both Carlisle and the Lake District National Park Parton and Distington offer the best rural yields anywhere in England. Here investors might expect to earn a full 8.52% annual return on their investment.

2. Flimby, Ellenborough & Broughton Moor, Cumbria

Staying in Cumbria but this time closer to the seaside town of Maryport this very rural area overlooking the Solway Firth should provide rural investors with a healthy 7.87% letting yield.

3. Loftus & Skinningrove, Cleveland

On the Cleveland coast and a short distance from the seaside towns of Whitby, Saltburn and the North Yorkshire Moors National Park Loftus and Skinningrove offer a buy to let return of around 7.67%.

4. Shildon, County Durham

Located in semi-rural County Durham yet easily accessible by the A1(M) for travel across the north east Shildon can offer property investors a solid 7.2% annual income.

5. Torpoint, Cornwall

Just across the River Tamar from the city of Plymouth and easily reachable by ferry Torpoint offers a healthy 6.88% return. The Rame Head Heritage Coast and some of Cornwall’s best-but-least-known seaside villages are just 15 minutes away.

6. Newbiggin by the Sea, Northumberland

Located on the rugged Northumberland coast, but just 23 minutes drive from Newcastle upon Tyne, the seaside town of Newbiggin offers investors a yield of 6.33%.

7. Askam & Dalton North, Cumbria

North of the busy town of Barrow in Furness but within just a few miles of the Lake District National Park and the Cumbria coast 6.32% is available to investors in Askam & Dalton.

8. Longtown & Border, Cumbria

A short drive from the border city of Carlisle, the M6 motorway and the Scottish Border the wide open spaces around Longtown can reward investors with an average 5.66% return.

9. Grimethorpe & Brierley, South Yorkshire

This former coalfield area is surprisingly rural, with miles of open countryside, yet has great access to the M1, A1 and A1(M) for those travelling around South Yorkshire. Grimethorpe near Barnsley can also offer investors a 5.66% annual return on their money.

10. Hoo Peninsula, Medway, Kent

This backwater within north Kent still has easy access to both Gravesend and the Medway towns. London can be reached in around an hour by train to St. Pancras. Investors should be looking to earn around 5.52% here.

About our results. Locations have been selected from the top 50 rural areas (using MSOA11 areas) in England sorted by the average (median) yield available on the market at time of preparation. The market used is a sample of property listings from Rightmove. Yield is estimated from the property asking price and an estimate rent for a property of that size and type in the given area.

Our data has been collected using PaTMa Property Prospector. PaTMa Property Prospector software helps property investors find and analyse the very best new property investment opportunities. PaTMa works by collecting, analysing and presenting complex data in a clear and simple way. It helps investors be better organised, find the best investment opportunities more easily, and saving time and money in the process.

You can find out more about PaTMa Property Prospector, and claim a free trial, here.