Update: The stamp duty rates have changed since this article was written. Please find our latest and updated details for SDLT, LBTT and LTT here.

The last few weeks have seen considerable changes to the Stamp Duty Land Tax system in England, designed to support the property market in the light of the Covid-19 pandemic. Scotland has also made changes to Land and Buildings Transaction Tax with Wales making changes to Land Transaction Tax too.

The details are different in every part of the UK so in this post we will summarise them all together in one place.

England: Stamp Duty Land Tax (SDLT)

Stamp Duty changes in England commenced on 8 July 2020 and are temporary until 31 March 2021. These changes also apply to Northern Ireland.

The changes reduced Stamp Duty to zero for all purchases up to and including £500,000. The portion of purchases over £500,000 are subject to the same Stamp Duty rates as previously.

This table shows the new temporary rates of Stamp Duty:

| Property value: | SDLT rate: |

|---|---|

| Up to £500,000 | Zero |

| The next £425,000 (the portion from £501,000 to £925,000) | 5% |

| The next £575,000 (the portion from £925,001 to £1.5m) | 10% |

| The remaining amount (the portion above £1.5m) | 12% |

Additional home supplement. The higher rate of Stamp Duty when purchasing second homes or buy to let properties still applies. This is charged at the rate of 3% on the entire purchase price and in addition to the rates above.

Some examples of possible Stamp Duty savings:

-

Owner occupier (non-first time buyer) purchase at £250,000. The buyer would have paid £2,500 Stamp Duty previously but will pay zero now. Saving £2,500.

-

Investor (or second home buyer) purchase at £250,000. The buyer would have paid £10,000 Stamp Duty previously but will pay £7,500 now. Saving £2,500.

Scotland: Land and Buildings Transaction Tax

Land and Buildings Transaction Tax (LBTT) changes in Scotland commenced on 15 July 2020 and will last until 31 March 2021.

The changes reduced LBTT to zero for all purchases up to and including £250,000. The portion of purchases over £250,000 are subject to the same LBTT rates as previously.

This table shows the new rates of LBTT:

| Purchase price: | LBTT rate: |

|---|---|

| Up to £250,000 | 0% |

| £250,001 to £325,000 | 5% |

| £325,001 to £750,000 | 10% |

| Over £750,000 | 12% |

Additional dwelling supplement. The ADS for additional dwellings still applies at the rate of 4% on the entire purchase price and in addition to the rates above.

Some examples of possible LBTT savings:

-

Owner occupier purchase at £250,000. The buyer would have paid £2,100 LBTT previously but will pay zero now. Saving £2,100.

-

Investor (or second home buyer) purchase at £250,000. The buyer would have paid £12,100 LBTT previously but will pay £10,000 now. Saving £2,100.

Wales: Land Transaction Tax

Land Transaction Tax (LTT) changes in Wales commenced on 27 July and will last until 31 March 2021.

The changes reduced LTT to zero for all purchases up to and including £250,000. The portion of purchases over £250,000 are subject to the same LTT rates as previously.

This table shows the new rates of LTT:

| Price Threshold: | Main residential rate: |

|---|---|

| The portion up to and including £250,000 | 0% |

| The portion over £250,000 up to and including £400,000 | 5% |

| The portion over £400,000 up to and including £750,000 | 7.5% |

| The portion over £750,000 up to and including £1.5m | 10% |

| The portion over £1.5m | 12% |

Higher residential rate. The higher residential rate for additional properties applies at 3% for purchases up to and including £180,000 and 6.5% for the portion above £180,000 up to and including £250,000. It then applies at 3% in addition to the above rates for the portion above £250,000.

Some examples of possible LTT savings:

-

Owner occupier purchase at £250,000. The buyer would have paid £2,450 LTT previously but will pay zero now. Saving £2,450.

-

Investor (or second home buyer) purchase at £250,000. The buyer would have paid £9,950 LTT previously and will still pay £9,950 now. No saving.

How to calculate Stamp Duty quickly and easily

The stamp duty holidays have made calculating what you will have to pay more complicated than ever before. Fortunately PaTMa offers a range of tools to help provide stamp duty figures when planning a property purchase. All these tools have been fully updated to include nation-aware stamp duty calculations in every case:

PaTMa’s price history and buy to let data browser extension. Whenever you are browsing property portals looking for prospective investments the extension will provide price history and basic financials about it overlaid onto each listing.

Simply install the free browser extension and create a free PaTMa account to use it.

PaTMa’s free buy to let profit calculator. Enter some basic numbers and see yield, ROI, profit, required investment, relevant stamp duty, available mortgage and more for any prospective investment.

PaTMa’s Property Prospector. Provides a much more extensive and customisable range of financial forecasts for buy to let investors.

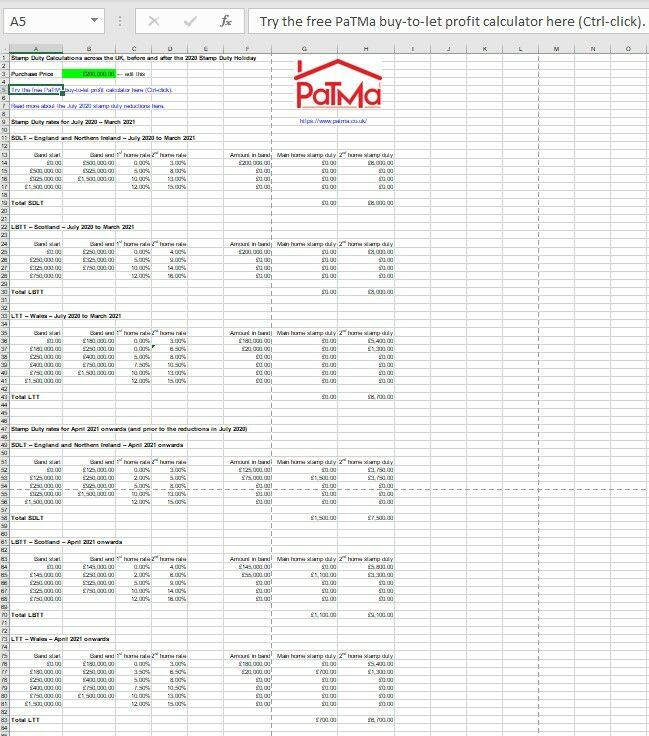

Warning: the spreadsheet below is outdated, our new stamp duty spreadsheet is here.

Click here to download an Excel stamp duty calculation spreadsheet which provides Stamp Duty calculations for all three countries, both before and after the changes.

If you need more information about how the system of stamp duty differs in Scotland and Wales then here’s a helpful blog post on the subject which we have previously published. (The stamp duty information in this post is still correct, it is only the rates that have changed as explained above.)

Stamp Duty In Scotland & Wales: How It’s Different And How To Calculate It