Update: This article and spreadsheet have been superseded as the stamp duty holiday changed and ended. Please find our latest and updated spreadsheet for SDLT, LBTT and LTT here.

Earlier today the chancellor, Rishi Sunak, made a Summer Statement that included an announcement to change the stamp duty bands.

The change to SDLT in England and Northern Ireland will be temporary. Starting immediately, on 8th July 2020, and staying in place until the 31st March 2021. From April 2021 the previous stamp duty bands will take effect again.

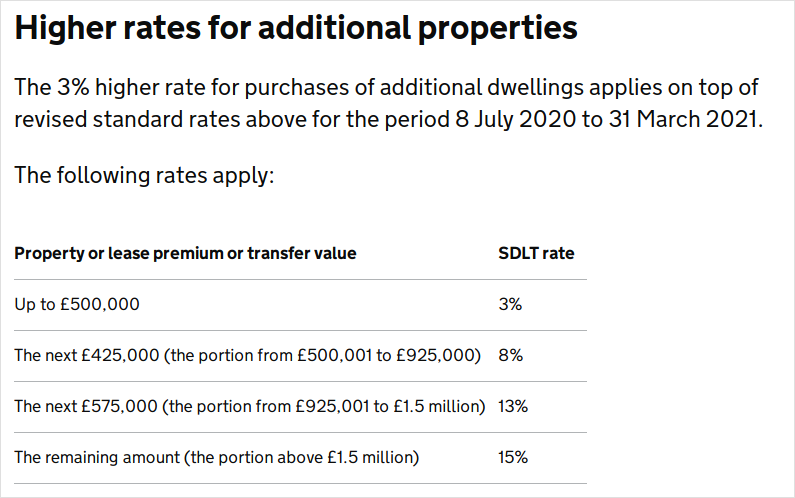

This has been branded as a "stamp duty holiday" for property purchases under the new threshold of £500,000. However, property investors will still be liable for the additional-home surcharge of 3% on the full purchase price.

Warning: the spreadsheet below is outdated, our new stamp duty spreadsheet is here.

Click to download an Excel stamp duty calculation spreadsheet with the new July 2020 - March 2021 SDLT thresholds.

This is an updated version of our previous stamp duty spreadsheet. Please see the previous article for full details on how the calculations are made, with Excel formulas and explanations. Only the thresholds used have changed in the spreadsheet above.

The table below is from the official government guidance and shows the new SDLT bands and rates applicable for additional-home purchases.

The stamp duty calculations used in all of PaTMa's online services were updated within an hour of the government announcement being made. The new SDLT calculation is now included in all of the buy-to-let forecasts you create with any of:

- PaTMa's free buy-to-let profit calculator.

- The price history and BTL data browser extension.

- Your personalised Property Prospector financial forecasts.

At the current time it's understood that neither Wales nor Scotland will replicate the stamp duty reduction for LTT and LBTT. You can view the current LTT and LBTT rates and calculations here.