When investing in rental property there are many factors to consider, such as location and letting potential. But the most important consideration is money: How much will I make from this property? Do the numbers add up?

Assessing profitability can be a complex equation, involving many variables. Not every property that appears to be a good buy will necessarily work financially. It is essential that you have the hard facts and figures to help you make sound investment decisions.

Here we’ll try to simplify the issue of how much you might make, and offer some ways to make it easier to spot the properties that will make you money.

Different types of return – Income and capital appreciation

There are broadly two types of return from a property investment – income and capital gain. While it is good to benefit from both some properties will offer strong income potential, while others will offer better potential for capital gain. Neither is necessarily better than the other. It depends on what your own personal investing objectives are.

Investing for income. If you require an income, or to supplement your income, right now look for a property that leaves you with surplus cash after all expenses have been deducted from the rent.

Investing for capital appreciation. If you want to amass a capital ‘lump sum’, perhaps for a future pension pot and without any need for immediate income, look for a property which offers good potential to gain in value over the years.

How much rent can I earn? This is fundamental to assessing how much you will make. A good approach is to search for local comparables. Look at the rents similar properties in the local area are achieving.

Key calculations to help you understand profitability

Here are some of the most useful calculations you can use:

Yield. Yield is a basic tool for assessing returns from a buy to let. The simplest figure to use is gross yield – divide the annual rent by the property’s likely purchase price to find a percentage.

Here’s more about yield, including the important differences between gross yield and net yield.

Return On Investment or ROI. ROI is the percentage return made on the cash that you put into a property after considering all expenses. It includes purchase costs and finance costs but normally excludes tax. Think of it as a comparison between what you put in and what you get out.

Here’s more information to help you calculate ROI.

Return On Capital Employed or ROCE. ROCE is a profitability ratio that measures how efficiently you are using your capital to generate profits.

ROCE is calculated by dividing earnings before interest and tax (EBIT) by capital employed (total assets minus current liabilities).

How tax affects your rental profits

Taxation impacts how much money a rental property earns you, whether you are investing for income or investing for capital gains or both.

Although they are not the only issues surrounding tax, these are important to consider:

The impact of Section 24. Section 24 of the Finance (No.2) Act 2015 phased out tax relief on mortgage interest. Section 24 affects different investors in different ways, depending on their borrowing and personal tax situation, even with an otherwise identical investment property. It is essential to calculate how it will affect you personally when evaluating a new property purchase.

Here’s more information on Section 24.

The impact of Capital Gains Tax or CGT. CGT affects all investors but especially those investing for a capital gain, particularly in the longer term. You may have to pay Capital Gains Tax if you make a profit (or ‘gain’) when you sell property other than your home, although you may deduct certain fees, costs of improvements and your personal CGT allowance.

More information about CGT is available on the official Government site.

It is always advisable to take professional advice on how tax affects your property investing.

How to work out the likely returns from your rental property

While you can assess potential returns using your own manual calculations PaTMa offers essential tools to help show how much you could make by doing the key calculations for you. Then presenting them in a crystal clear, easy to understand way.

PaTMa Buy to Let Property Profit and Tax Calculator

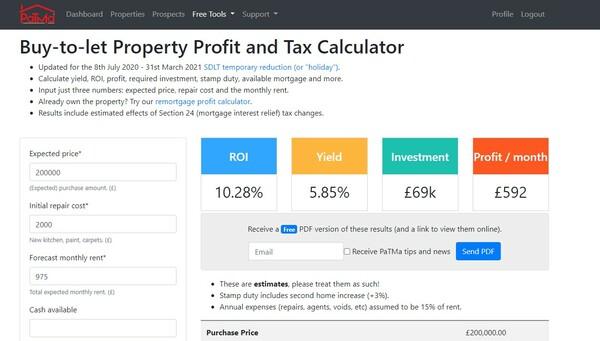

PaTMa’s BTL Property Profit and Tax Calculator is a quick and simple way to get an instant snapshot of how much you could make from a property. Just input three numbers – purchase price, repair costs and monthly rent. Then yield, ROI and expected monthly profit (as well as other invaluable data) will be calculated for you automatically.

Here’s an example:

The Buy to Let Property Profit and Tax Calculator is free to use.

PaTMa Property Prospector

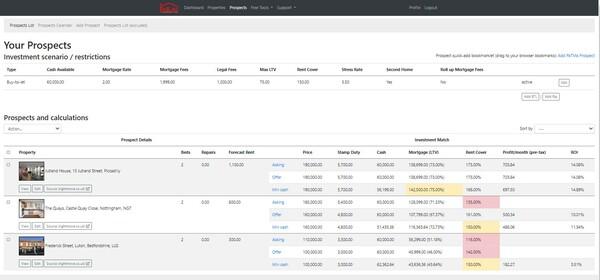

PaTMa Property Prospector can provide much more comprehensive financial information and financial forecasting. You can adjust and customise it to suit your own situation and investment scenarios.

With Property Prospector all you need to do is enter a property as a prospect and add some relevant figures once only. Then PaTMa instantly calculates and shows essential financial forecasts such as cost, yield, purchase price-v-yield, profit and ROI. It allows for taxes, fees, repair and maintenance costs and interest costs. It will show the impact of Section 24 according to your tax band. It will even show rent level comparables and provide a five year profit forecast including estimated capital gain, plus a whole host of other valuable data and information.

PaTMa Property Prospector gives you the essential information you need to decide how much you could make from every potential new rental property, saving you hours of manual calculations and eliminating guesswork.

Alongside the paid subscription Property Prospector offers valuable financial data about each prospect for free. You can choose to upgrade to a paid subscription as and when you like.

Here's an example: