When completing your landlord tax return you’ll want to make sure it is completed accurately. Here are our tips and advice on completing your self assessment landlord tax return properly.

Completing your landlord tax return: Paper or digital

The first question all landlords need to ask when completing their landlord tax return is whether to do it on paper or go digital.

Both paper and digital systems are acceptable for landlord tax returns, so it is just a matter of personal preference. However, it is a good idea to decide which method you are going to use and be consistent from the beginning.

If you use a paper system you will need to keep paper copies of bills, receipts and invoices in a filing system. (If you also plan to submit a paper landlord tax return remember that the filing date for this is earlier.)

See here for more information on ways to file your tax return and the deadlines for doing it.

If you are keeping digital tax records you can either scan, or take photos, of your bills, receipts and invoices.

When should you start on your landlord tax return?

There are two main approaches to collecting the information you need for your landlord tax return: You can either do it on an ‘as you go’ basis monthly or weekly. Or you can wait until the end of the tax year. Both approaches are acceptable, although doing it as you go avoids a last minute rush.

The PaTMa Landlord Tax Return feature works with either approach, so fits in with whatever method suits you best. Here’s more information on how it works.

What information is needed to complete your landlord tax return?

To complete your landlord tax return you’ll need to collect details of all your letting income and all your allowable expenses together and all the documents to support them.

Information about your landlord income

As a landlord your income includes both your rent received and any other money you receive from your tenants, such as for service charges.

If you take a deposit from your tenants and later need to deduct money from it – for example, for any damage your tenants are liable for – this should also be included as your income.

These are the documents you will need to help you complete your tax return:

If you collect your rent direct from your tenant: Give receipts to your tenants and keep copies of them. If your tenants pay your rent directly into your bank account keep copies of your bank statements showing these.

If a letting agent collects your rent for you: Keep the rental statements they send you.

Tip. If you use a letting agent include all the rent your tenant pays when completing your landlord tax return – not just the net amount you receive after they have deducted their agent’s fees. Letting agency fees should be claimed separately as an expense.

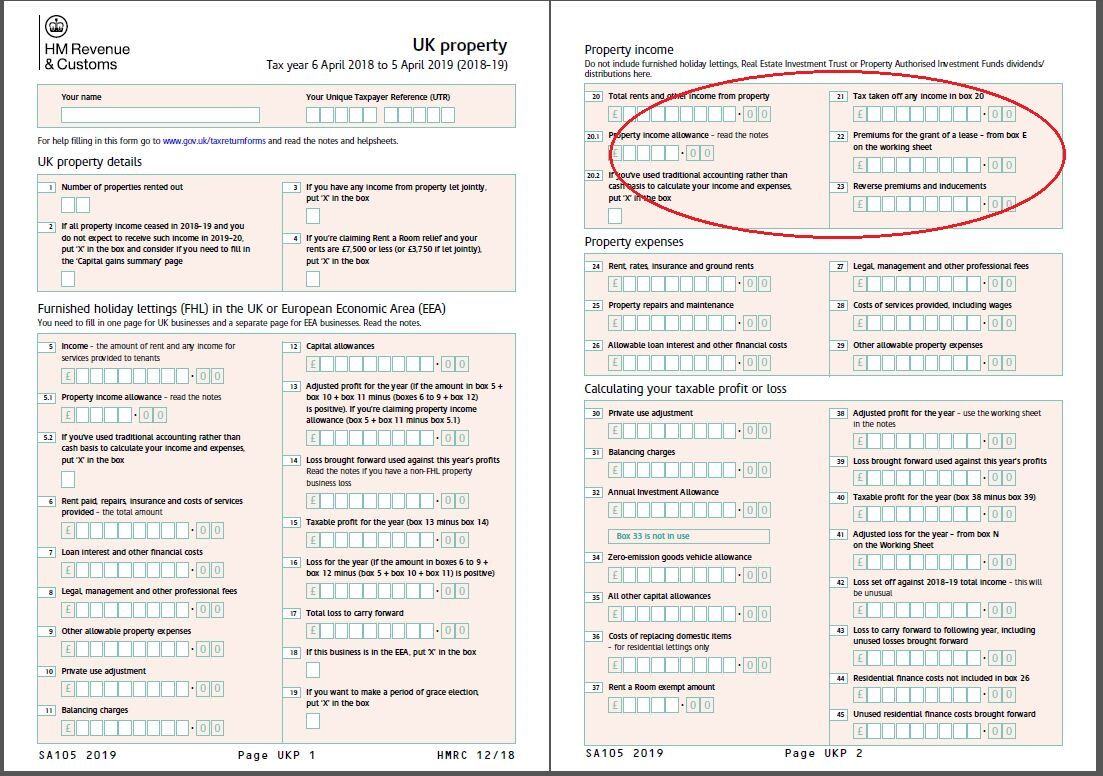

The figures for your property income go in Sections 20-23 of the HMRC UK Property pages of your tax return here:

UK Property Form: Property Income Section

Information about your landlord expenses

When it comes to allowable expenses, these are the documents you will need to help you complete your landlord tax return:

-

Invoices and statements from letting agents and property management companies showing their charges.

-

Utility bills, Council Tax bills or ground rent bills you pay for your property.

-

Insurance renewal notices for the landlord insurance you pay.

-

Invoices from companies who provide you with services like cleaning, gardening, property maintenance and repairs.

-

Wages records and cash payments for any staff you employ, full or part time or casual.

-

Invoices or receipts for any materials you buy for maintenance or repairs. For example, cleaning materials, paint or parts to repair a broken WC.

You can only claim allowable expenses for maintenance and repairs. Improvements to your property are capital expenses and not allowable expenses.

-

Invoices or receipts for domestic items such as furniture or appliances you buy for your property. These are not an allowable expense but you may be able to claim Replacement of Domestic Items Relief for them.

-

Receipts for your own office and other administrative expenses. This might include phone bills, the cost of obtaining references, legal expenses, advertising your property and travel/transport receipts.

You can only claim expenses incurred wholly and exclusively in your letting business. In the case of expenses that are partly connected with your lettings business and partly private expenses keep the invoice or receipt to help you complete your landlord tax return but only claim the business part of it as an allowable expense.

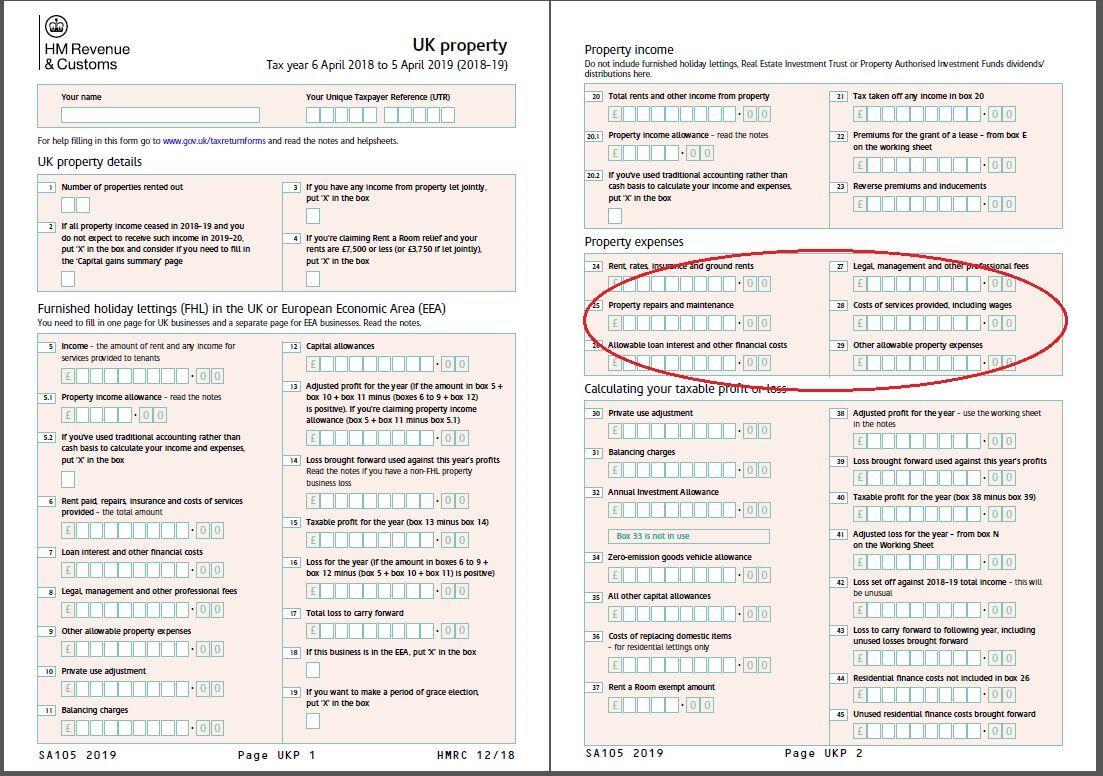

The figures for your property expenses go in Section 24-29 of the HMRC UK Property pages of your tax return here:

UK Property Form: Property Expenses Section

Examples of expenses that are allowable and not allowable

You pay a self employed part time gardener £300 a month to maintain the garden at the rental properties you own as well as maintaining your own private garden. The gardener gives you a receipt for £300. You should keep this for your landlord tax return, but you should only claim the part of it that applies to your rental properties as an expense.

How to deal with mortgages

Mortgage payments are a special case when completing your landlord tax return. You make one, single monthly mortgage payment but you can only claim a tax credit for the interest portion of it, not the capital repayment part of it (if any).

To help you complete this section of the landlord tax return correctly look at the mortgage statement sent by your bank or building society. This will show you what interest you have paid and what capital you have repaid as separate sums.

How the PaTMa landlord tax return feature works

Completing your landlord tax return used to be complicated, time consuming and often frustrating. But the PaTMa landlord tax return feature now simplifies and streamlines the procedure of completing your landlord tax return, saving you time and money in the process.

Here’s a useful blog post about how PaTMa works. It shows how you can quickly and easily add properties and new tenancies, record rental payments, record your expenses and mortgage interest and then automatically generate the figures to complete your landlord tax return.

Forms and helpsheets

If you need more information, all the HMRC Self Assessment forms and helpsheets for UK property are here.