If you're a landlord – or planning on becoming a landlord – you'll need to complete a landlord tax return. Here we explain exactly what a landlord tax return is and how to get started on yours.

Who needs to complete a landlord tax return?

Everyone who is making an income from property needs to complete a landlord tax return. Whether you're a full time professional landlord, or just letting property as a sideline, then HMRC expect you to complete a landlord tax return.

There is one small exception to this rule: The property allowance is a tax exemption which means that if your annual gross property income is £1,000 or less you do not need to complete a landlord tax return.

How to register as a landlord

To complete a landlord tax return you first need to register as a landlord, if you haven't already done so. This process is much the same as when registering any other kind of self employed business or sole trader.

You need to register by 5 October in your business's second tax year at the very latest.

You can register as a landlord online by going to the HMRC Register for and file your Self Assessment tax return page here.

You can fill in the form online and then print and post it if you prefer.

Once you register HMRC will send you a letter in the post giving you your 10 digit Unique Taxpayer Reference or UTR for short. They will also set up your account for the Self Assessment online service.

When you need to complete your landlord tax return

If you are filing your landlord tax return online you need to file it by midnight on 31 January following the end of the relevant tax year. For example, your landlord tax return for the 2019-2020 tax year needs to be filed by 31 January 2021.

If you complete a paper landlord tax return the deadline is earlier. You need to file it by 31 October following the end of the relevant tax year.

Whichever method you use to file your landlord tax return any tax you owe has to be paid by 31 January.

What happens if you don't file your landlord tax return?

There are strict deadlines for completing your landlord tax return. If you miss them you will be charged a penalty of £100 for completing your return up to 3 months late, and even more if it is filed after that. You'll also have to pay interest on any tax due.

Tip. You can wait until January to collect and compile the figures you need for your landlord tax return. However, the PaTMa landlord tax return feature allows you to collect the information you need month by month throughout the year. This way all the information you need to complete your landlord tax return will be ready as soon as each tax year ends, avoiding a last minute rush. For more information see here.

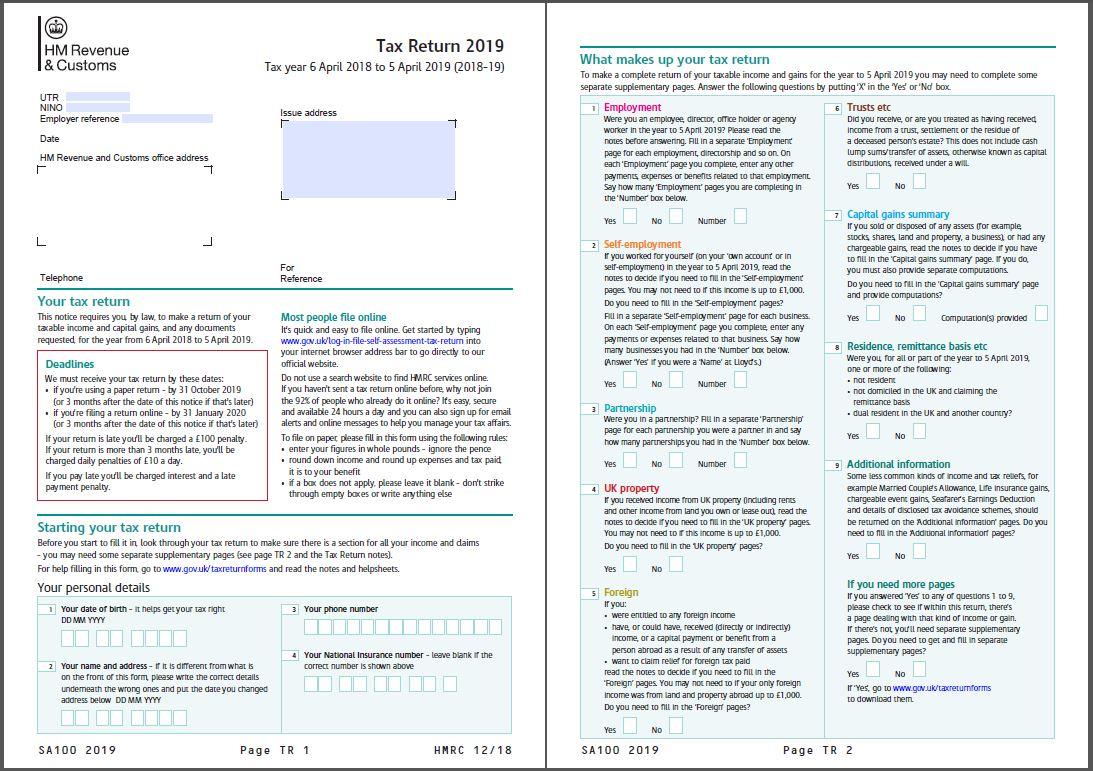

Self assessment tax return form

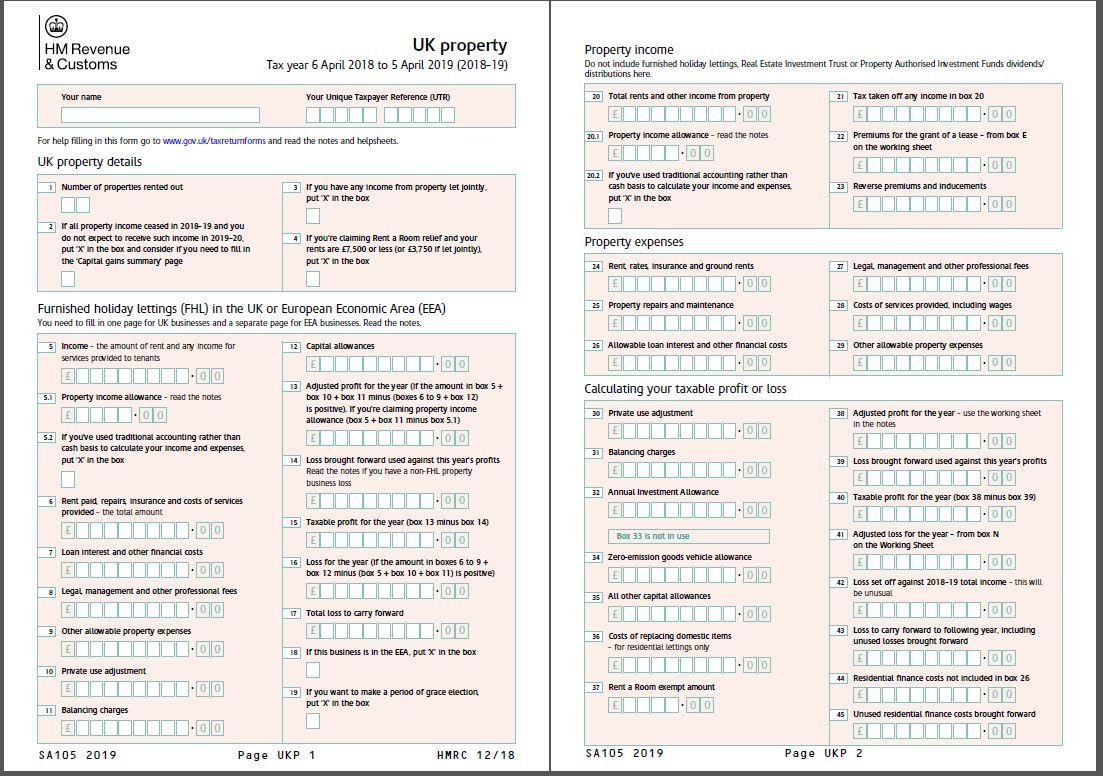

UK Property form

What counts as income for a landlord?

When you complete a landlord tax return you need to declare all the income you have made from your property business. But there are two different types of income to declare – letting income and general trading income.

Letting income includes rents you receive from tenants, charges for utilities (if you charge for utilities) and any property-related service charges such as for the cleaning of communal areas or grounds maintenance.

General trading income includes money you receive for providing anything that is not directly property-related. For example, for laundry or meals that some landlords provide to their tenants.

Tax allowances landlords can claim

Landlords can claim a number of allowable expenses when completing their landlord tax return. The main categories of these are:

-

Fees paid to letting agents and property management companies.

-

Any utility bills, Council Tax or ground rent you pay for the property.

-

Insurance, both buildings insurance and contents insurance.

-

Money paid out, or staff wages paid, for cleaning, gardening etc.

-

General maintenance and repair costs.

-

Your own office and other administrative expenses.

All allowable expenses need to be incurred wholly and exclusively in your letting business. If you have some expenses that are partly connected with your lettings business – say for example you have a car that you use partly for business and partly for personal use – you can claim the relevant part of those expenses.

Expenses that aren't allowable on a landlord tax return

There are certain expenses that are not permitted as allowable expenses on your landlord tax return. These include:

-

Capital expenditure. That is, the cost of buying, equipping or improving your rental property. (But remember that maintenance and repairs are an allowable expense.)

-

The cost of replacing domestic items, such as furniture or appliances provided. You may be able to claim these costs as what is known as Replacement of Domestic Items Relief, but not as an allowable expense.

-

Mortgage interest repayments. Since April 2017, tax relief on mortgage interest has been gradually phased out under changes brought in under Section 24 of the Finance (No.2) Act 2015. Here's more information on Section 24.

The 2019-20 tax is the last year mortgage interest is deductible (at 25%) under this system. However a tax credit, limited to 20%, is now available instead.

Examples of expenses that are allowable and not allowable

-

You purchase a buy to let house which does not have central heating and decide to install central heating before letting it out. This is capital expenditure and so you can't claim it as an allowable expense.

-

You own a buy to let flat which has central heating and the boiler breaks down. You can claim the cost of repairing it, or replacing it with a similar brand new boiler, as an allowable expense.

How the PaTMa landlord tax return feature works

Collecting the information you need for your landlord tax return used to be complicated, time consuming and often frustrating. But the PaTMa landlord tax return feature now simplifies and streamlines the procedure of completing your landlord tax return, saving you time and money in the process. You can find more information on the benefits the PaTMa landlord tax return feature offers here.

Forms and helpsheets

If you need more information, all the HMRC Self Assessment forms and helpsheets for UK property are here.