PaTMa Property Prospector now supports buy to sell (aka buy, refurbish and sell or "flip") investment scenarios in addition to buy to let.

The new buy to sell investment strategies are available on the Professional and Agent subscription plans which both already allow you to create multiple buy to let investment scenarios.

There are more details and screenshots below but if you'd rather watch a short video, here's a walk through for creating a buy to sell scenario and adding your first prospective property.

Creating a buy-to-sell scenario

Making use of the new buy, refurbish and sell calculations all starts with the creation of a new investment scenario within your Property Prospector account (note that a Professional or Agent subscription is required).

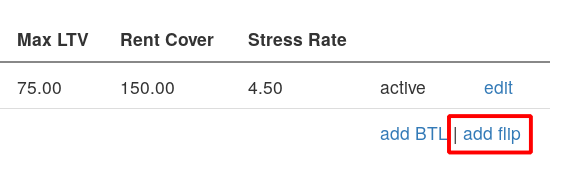

The link to get started is available just under your current list of investment scenarios, on your prospect listing page.

Enter the buy-to-sell and bridge finances

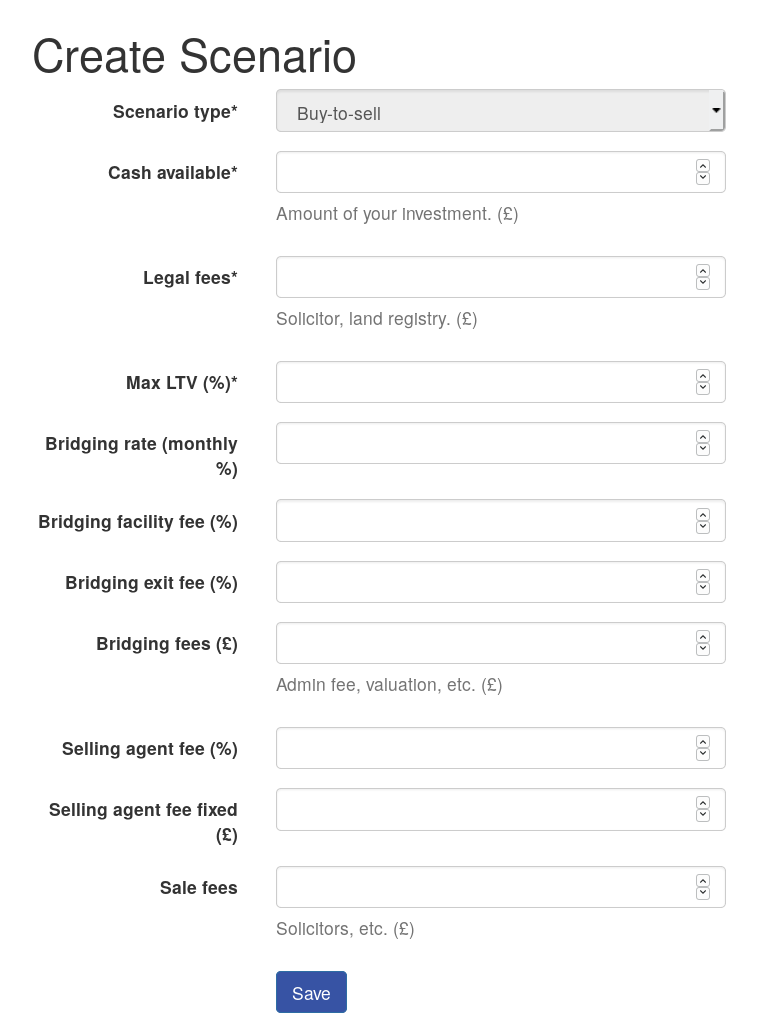

The next step is to enter the basic financial information for the investment scenario you're looking for. As a buy-to-sell scenario, it's based around bridging finance (or no finance at all) so the details are a bit more complex than a standard buy to let mortgage.

A quick run down of the fields and their meaning:

- Cash available - the maximum amount of money available to put into a deal, PaTMa will show calculations for using all of this cash, and using as little of it as possible, so your results aren't tied to this amount.

- Legal fees - your cost of purchase legal fees, including searches, etc.

- Max LTV - the maximum loan to value available from your bridging lender.

- Bridging rate (%) - the monthly interest rate on your bridging product.

- Bridging facility fee (%) - most bridging loans charge a facility or setup fee based on a percentage of the loan, enter that percentage here.

- Bridging exit fee (%) - some bridging loans charge a percentage based exit fee, if that's the case for you, enter it here.

- Bridging fees (£) - enter the fixed fees involved in the bridging loan here - admin, valuation, etc.

- Selling agent fees (%) - if you're using a traditional agent to sell the property they'll probably charge based on a percentage of the sale value, enter that percentage here.

- Selling agent fee fixed (£) - alternatively you might be planning to use a fixed price agent, if that's the case enter zero in the % box above and enter the fixed price in this one.

- Sale fees - your cost of sale, solicitors, perhaps staging costs, etc.

Entering prospects

With multiple investment scenarios now enabled, each new prospect must be allocated to one of them. A new field will appear at the top when creating (or editing) prospects so that you can choose the investment scenario to allocate it to.

For the buy, refurbish and sell calculations to provide sensible results you also need to complete at least the following figures for each prospective property:

- Expected price - what you expect to pay for the property.

- Initial repair cost - the total cost of the refurbishment.

- Initial repair months - how long you expect to hold the property, to cover the refurbishment and sale. This is used to calculate the duration of the bridging loan and also required ongoing expenses (see below).

- Sale price - what you expect to sell the property for.

You may also want to customise the "Ongoing expenses" section. For buy-to-let investments this defaults to a (possibly reasonable) 15% of rent, however in a buy-to-sell scenario that calculation doesn't make sense. There will still be ongoing expenses though while you hold the property - council tax, utilities and perhaps service charges. More details on customising ongoing expenses are available in that previous article.

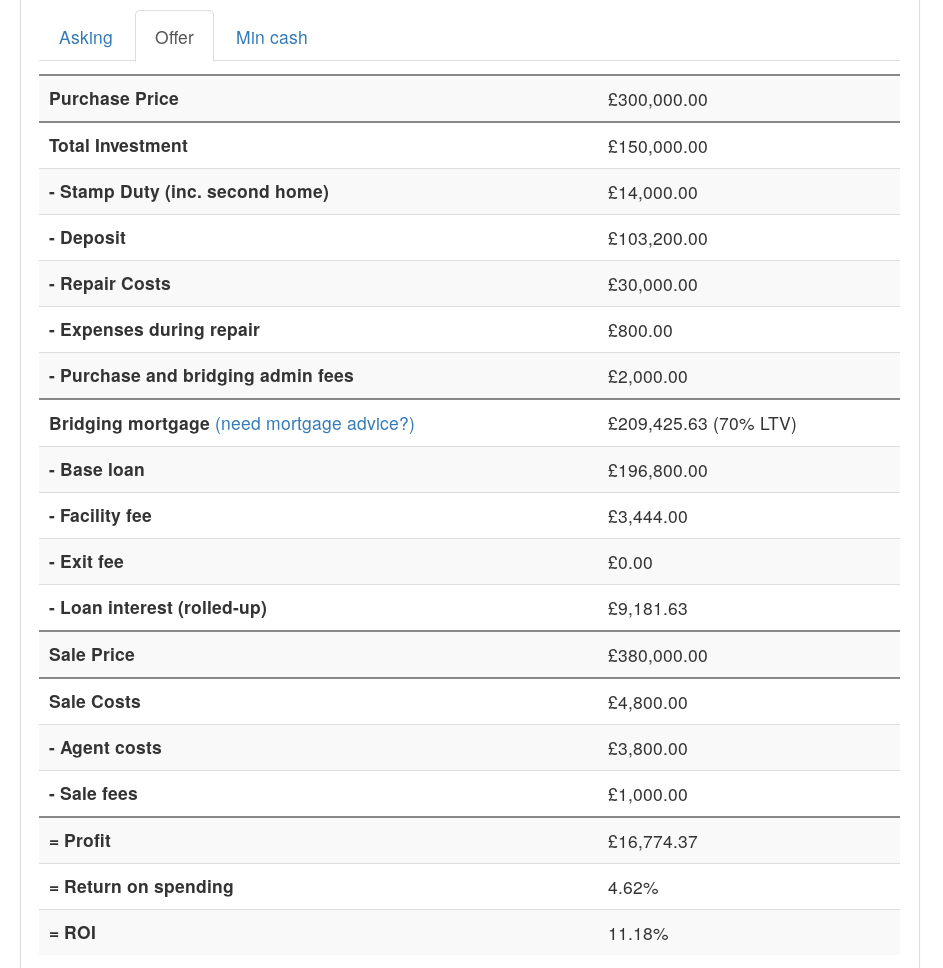

The calculated results are a bit different to those for the [buy to let calculator] - they include extra detail on the bridging finance fees and interest. More significantly though, there is no ongoing, monthly or longer term profit forecast. Instead there is only a single profit figure, and the corresponding return on investment (ROI) figure.

Buy-to-sell calculation results

Having created a buy-to-sell investment scenario and attached a propective property investment, PaTMa will calculate your profit:

The calculations also show all bridging interest and costs, fitted to the maximum LTV criteria. The corresponding deposit, stamp duty and refurbishment costs are all calculated and rolled up to show the total investment actually required for the project. Assuming you achieve the expected sale price, forecast profit and ROI figures are also shown.

Once back to your prospect listing page you can sort and compare your flip prospects.

Efficient property management

The new buy, refurbish and sell calculator is only available for professional and agent subscribers of PaTMa Prospector. However you can start tracking your future property investments with buy-to-let calculations by creating a free account.

PaTMa's mission is to make property management more efficient, saving you time and money with simple, streamlined processes.