You can use PaTMa to simply track all your landlord finances and it comes complete with a tax return report to help with your self assessment.

This article is part of a series guiding you from an empty account, through entering all the data required, to PaTMa calculating your landlord tax return figures.

You can find the other parts here:

Part 1 - Creating your properties

Part 2 - Adding tenancies and adjusting to ignore the past

Part 3 - Recording rent payments

Part 4 - Recording mortgage interest

Part 5 - Recording other expenses (this post)

Part 6 - Generate and check your tax figures

What you'll get

After this part of the guide you'll have all your property expenses recorded. In fact you'll have everything recorded that you need to generate your tax return figures (see Part 6 for how).

What you need

- Invoices

- Receipts

- Credit card statements

- Bank statements

- And anything else that shows your property expenses for the year

What to do

If you can, I recommend grouping your expenses per property before starting to enter them into PaTMa. This will save you some clicking between screens and it will also make it easier for double checking your paper records against the (per property) expenses list in PaTMa.

Don't worry if you'd rather enter everything in date order, for example working through credit card or bank statements. Just make sure you click into the relevant property for each expense.

Here's the basic process to record each property expense:

- From the property list...

- Click the appropriate property image

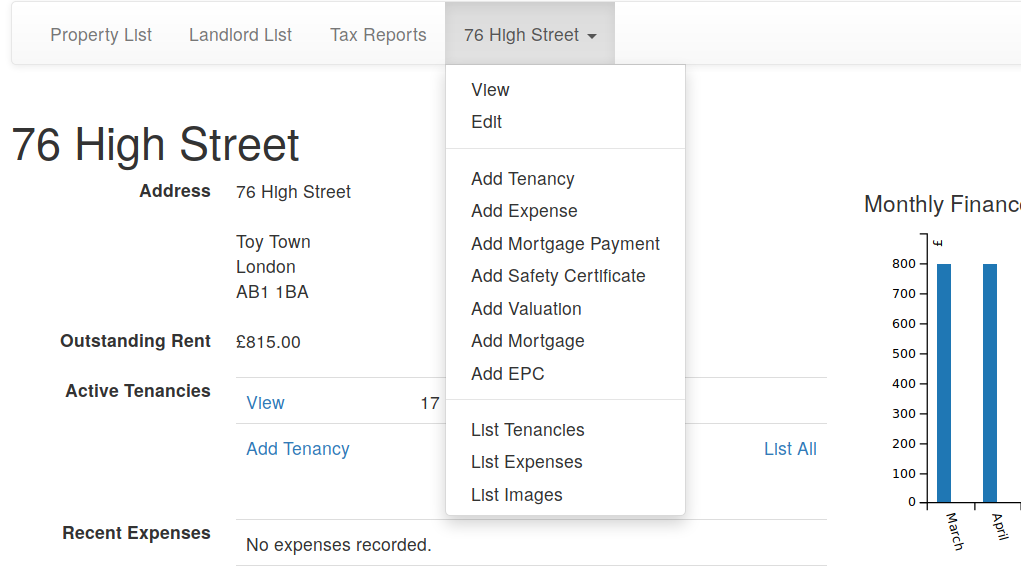

- Open the property menu

- Click the "Add expense" menu item

Here's what the menu will look like:

Alternatively:

- On the property detail screen, scroll down a little to the "Recent Expenses" section

- Click the "Add Expense" link just under the table

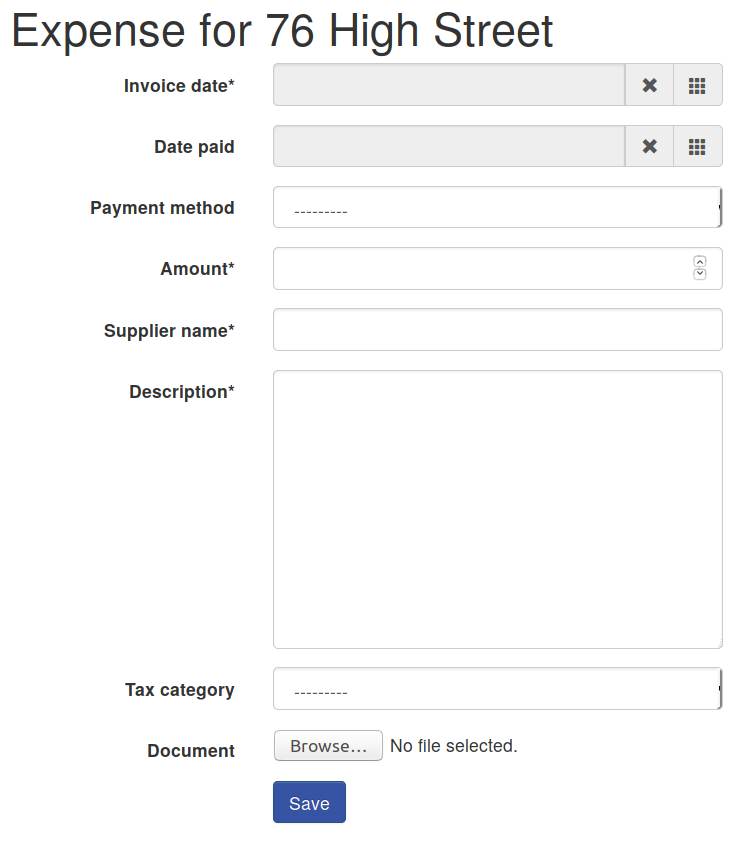

Once you've selected Add Expense by either method, you'll see a form that looks like this:

Most of this form should be self explanatory, but there's one field that's especially important - Tax category.

You need to make sure that you allocate each expense to the correct tax category, otherwise you may end up paying too much tax (or too little!). There's lots of information and guidance on property expenses on the HMRC site.

Getting the tax category right for these expenses is probably the most important part of this entire process. If you're in any doubt at all we strongly suggest that you seek professional advice. (We recommend Paul Samrah, partner at Kingston Smith, who can be reached on 01737 778546 or email: psamrah@kingstonsmith.co.uk.)

Make sure you fill in the supplier name as this is visible in summary listings and I strongly recommend making the description as detailed as you can so it's easy to understand in the future.

If you've got an electronic copy of the invoice or receipt for the work, you can add that using the "Document" field so it's always available for safe keeping (or any future tax inspection!).

Click "Save" to complete the process (or "Save + enter another" to enter another expense for the same property). Then repeat for each of your property expenses.

What next

Congratulations! You've entered all the information needed to generate your landlord self assessment tax figures. Click through to the final part of this guide to see how to view and check your landlord tax return.