You can use PaTMa to simply track all your landlord finances and it comes complete with a tax return report to help with your self assessment.

This article is the last part of a series guiding you from an empty account, through entering all the data required, to PaTMa calculating your landlord tax return figures.

You can find the other parts here:

Part 1 - Creating your properties

Part 2 - Adding tenancies and adjusting to ignore the past

Part 3 - Recording rent payments

Part 4 - Recording mortgage interest

Part 5 - Recording other expenses

Part 6 - Generate and check your tax figures (this post)

What you'll get

The key income and expense figures suitable for use on your HMRC self assessment property pages.

What you need

You'll need to have completed all the previous parts of this guide (see above for links to each) and have records on hand to review your details.

What to do

You've done all the hard work, now it's time to enjoy the results. Just a few clicks stand between you and all the basic (for most buy-to-let landlords) self assessment property tax figures.

Get started by clicking "Tax Reports" on the navigation above your property listing page. You'll be presented with a form to select the tax year you'd like a report for:

Simply select the relevant year and click "Create Report".

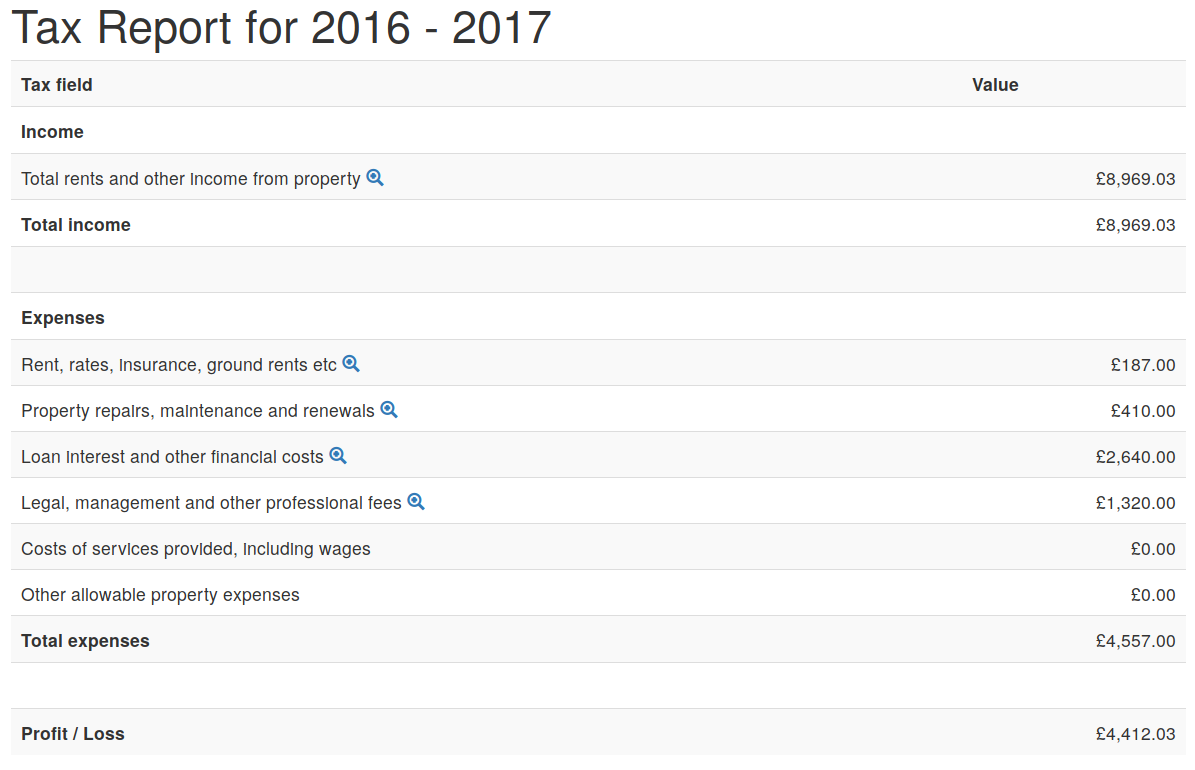

A few seconds later you'll be presented with the tax report for your portfolio in the chosen year. It should look something like this:

The figures shown should be ready to copy and paste into your HMRC online tax return.

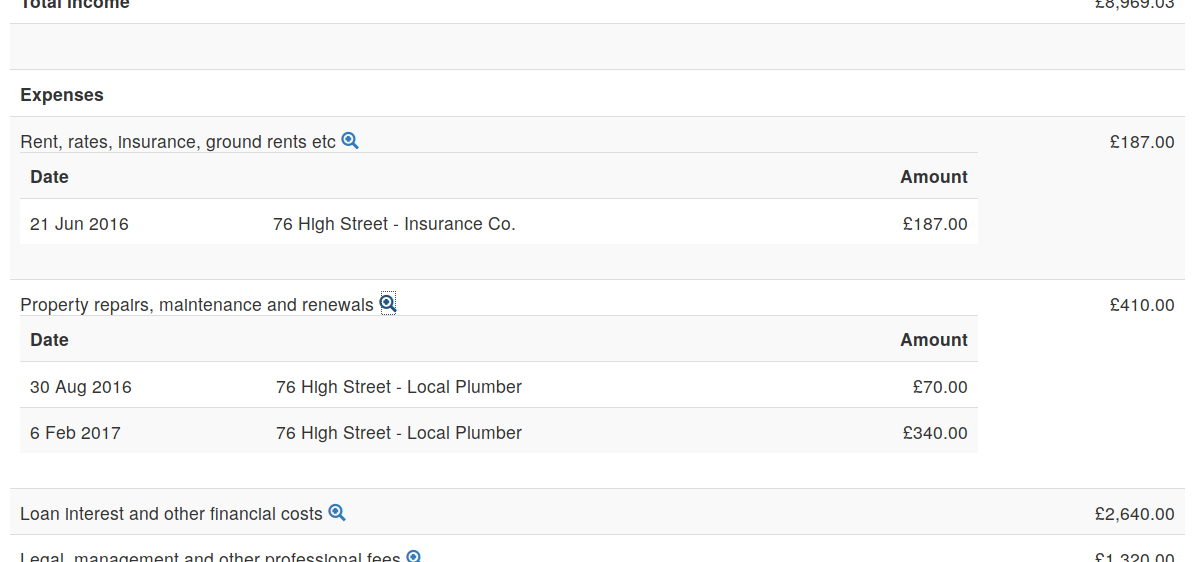

Just before you do though, we recommend that you take advantage of the little magnifying glass icons to expand each of the report sections and verify that the transactions included match your expectations.

Here's a quick example of a tax report with a couple of the detailed lists open:

Use the dates, descriptions and amounts displayed to check for any typos or other mistakes. It's a good idea to quickly reconcile the transactions shown with your bank statements.

Once you're satisfied everything is in order, head over to HMRC and fill in your self assessment.

Please note: these tax return calculations are entirely dependant upon the data entered and it's accuracy. It's critical that you check the results yourself (use the per-item quick expansions to see the data behind each total). If you're in any doubt at all we strongly suggest that you seek professional advice. (We recommend Paul Samrah, partner at Kingston Smith, who can be reached on 01737 778546 or email: psamrah@kingstonsmith.co.uk.)

What next

That's it! You're all done.